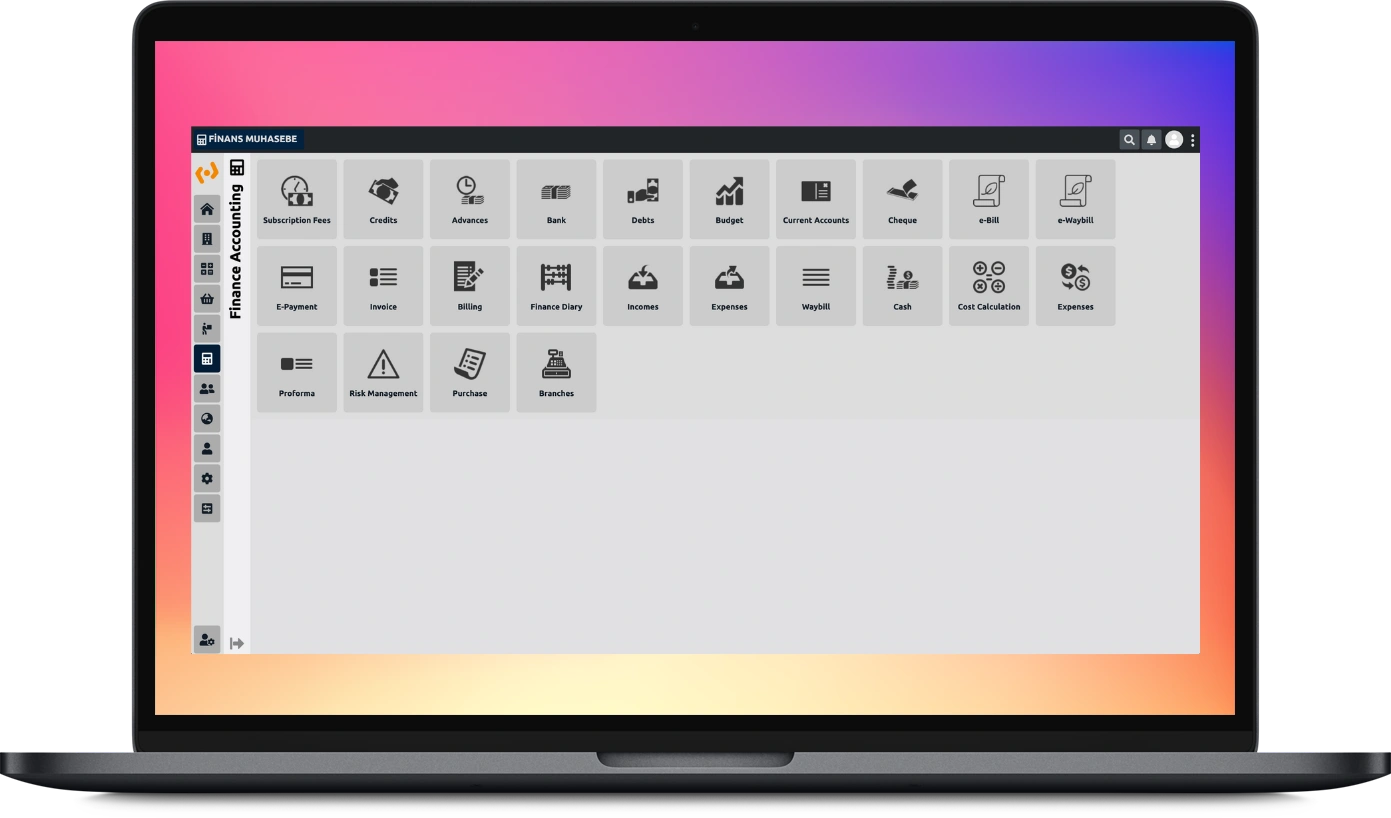

Manage Your Financial Transactions

Manage cash management, collection, payment, transfer and handover transactions from a single screen with finance and accounting integration.

Powerful Financial Management Features

Effortlessly manage your accounts payable and receivable, accounting, budgeting and financial reporting processes; automate invoicing, expense tracking and reconciliation processes.

Payables and Receivables

Define payable and receivable categories, payment types, and track due dates. Instantly view your payables and receivables with and without due dates on a customer basis.

Expense Management

Create expense forms such as domestic and international travel, meals, transportation, and define the approval processes of superiors, financial affairs, and general managers.

Cash Flow Management

Track your daily income-expense, expense and advance transactions from a single screen, easily list your payments, invoices and proformas.

Risk Management

Determine risk limits by analyzing the payment habits and financial performance of dealers and sub-dealers, and follow up on open account status and payment preferences.

Budget Planning

Plan your budget, compare targeted and actual income-expenses and analyze the differences and realization rates.

Asset Management

Manage fixed assets on a branch basis, register them in different branches, debit them to personnel and associate them with other fixed assets.

- How can I keep track of payables and receivables?

You can monitor your financial status according to debt and receivables categories and plan your payment and collection processes.

- How can I manage my expenses?

You can create expense forms for different categories such as travel, food, and transportation; define approval steps, and add authorities such as managers, finance, or general managers to these steps.

- What are the general applications of Financial Accounting?

Expense management, budget planning, cash flow management, cash and bank tracking, check and promissory note tracking, fixed asset management, advance tracking, payable and receivable tracking applications are the general applications of finance and accounting management.